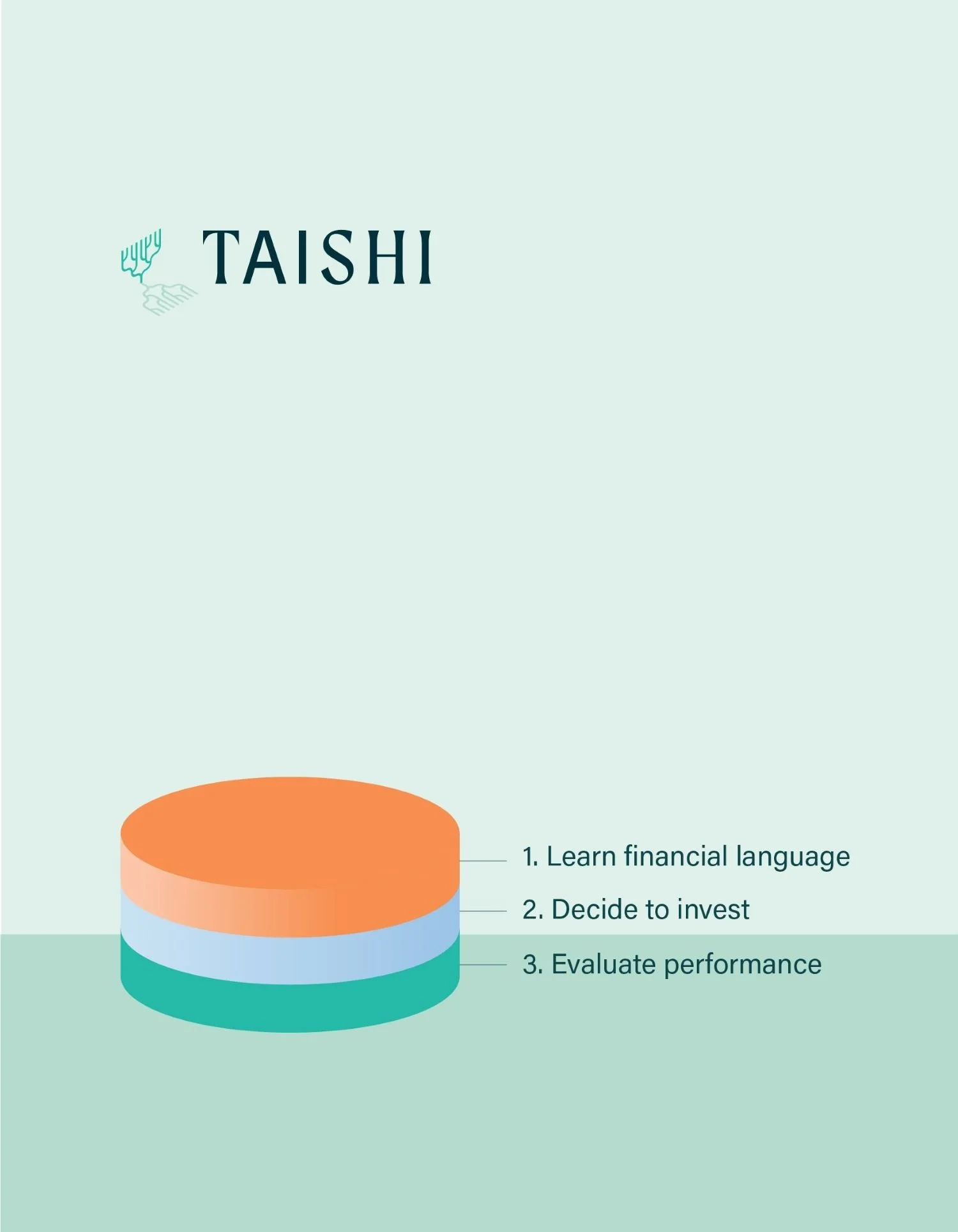

Our innovative solution

One fund

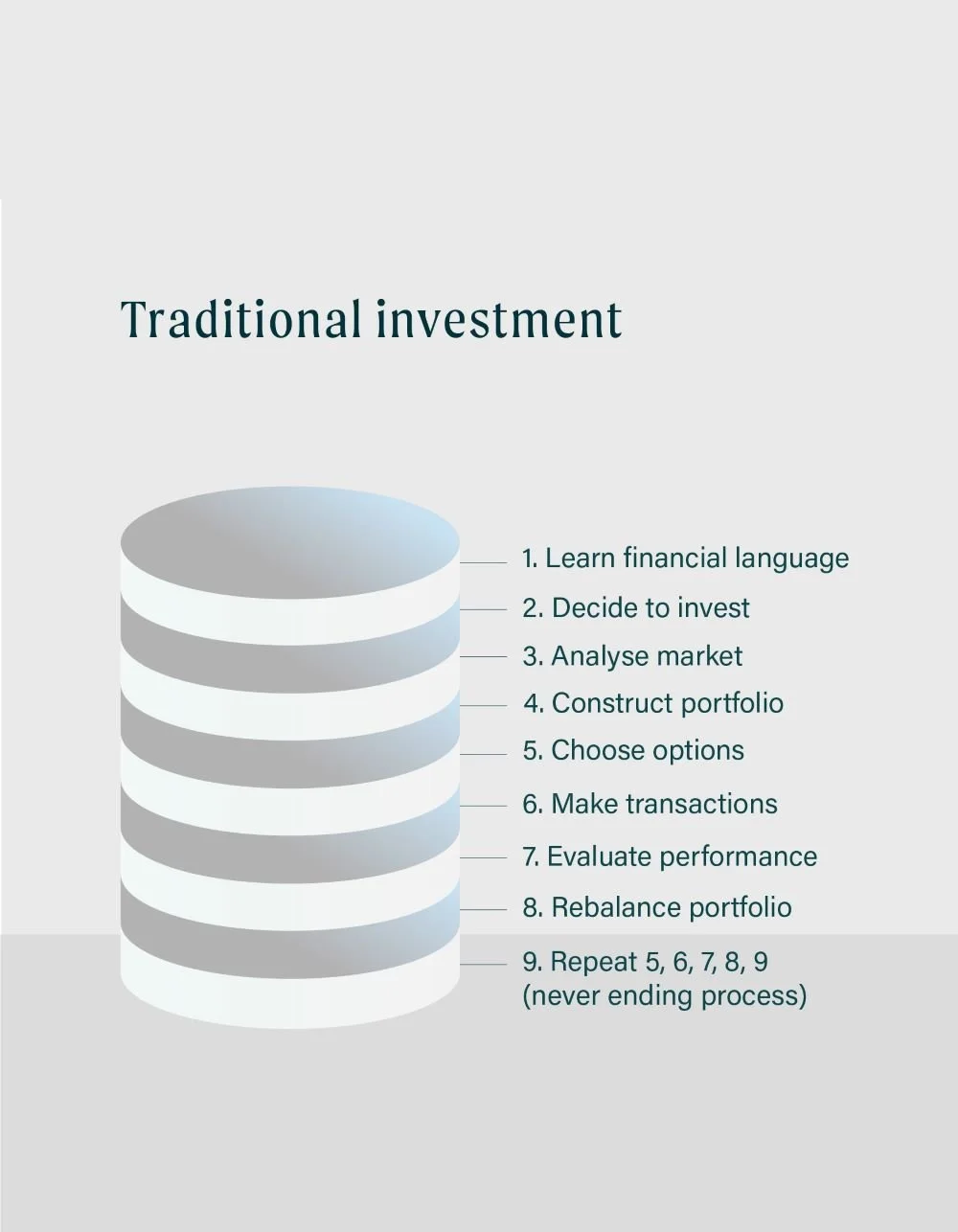

In the dynamic investment landscape, Taishi.io redefines wealth management, blending modern portfolio theory, digital automation, and customer-centric philosophy. We address traditional model issues, prioritizing simplicity, efficiency, and a risk-minimizing strategy for sustainable growth.

We understand investing's inherent uncertainties. We commit to continually refine our investment engine, adapt to challenges, and strive to transform Thailand's investment landscape, prioritizing our customers’ wealth wellbeing.

We offer just one fund. This eliminates the need for endless options, comparisons, and manual work.

Other investment firms also invest in our top 5 holdings

S&P 500 ETF: I-10 by MFC Asset Management

Ark Innovation Fund: SCBROBOA by Siam Commercial Bank Asset Management

US treasury: K-MBOND by Kasikorn Asset Management

Gold ETF: KF-ORTFLEX by Krungsri Asset Management

Apple Inc.: B-BHARATA by Bualuang Asset Management

As of June 30, 2022-

Our Investment Strategy:

Our unique strategy is inspired by the principles of an all-weather portfolio with an innovative Mechanical DCA system and advanced automated rebalancing, streamlining investment processes and operations. This creates a portfolio mix that mitigates standard deviation for a Sharpe ratio higher than 1.0, striking a delicate balance between risk and return. The strategic use of short selling and volatility indexes further hedge against market downturns and enhances returns. Our Investment Engine's sophisticated automation facilitates complicated portfolio construction, reflecting up-to-date investment forecasts and market views.

Risk Management:

Our comprehensive approach to risk management uses key measures like VaR, stress testing, and Sharpe's ratio, focusing on investor wealth protection within Thailand's strict financial regulations.

The Opportunity:

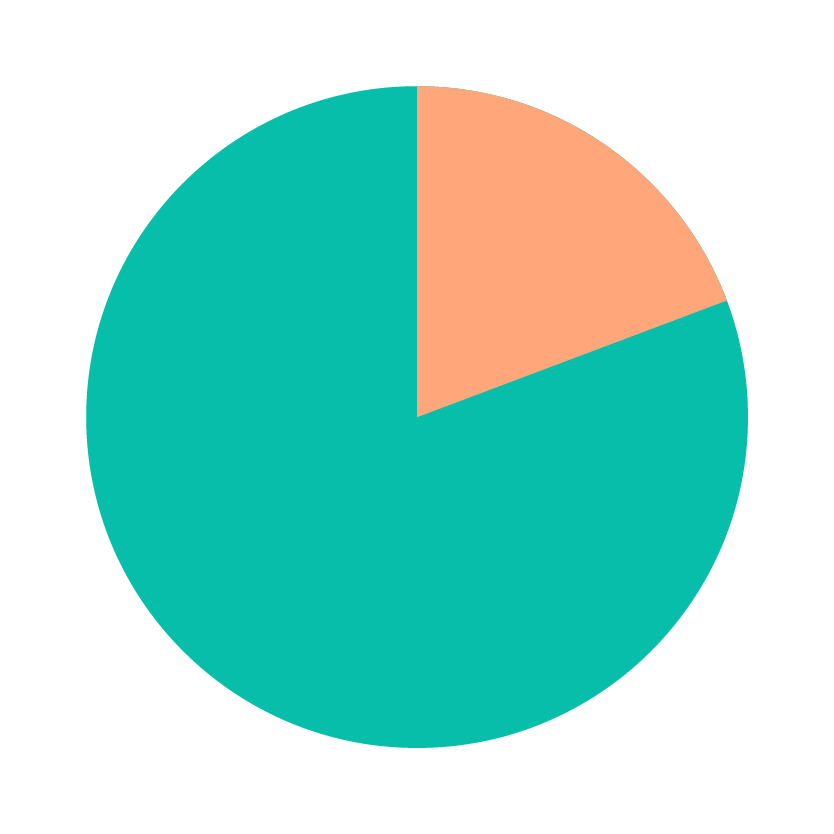

As digital transformation pioneers in Thailand's financial landscape, we're positioned to leverage this opportunity, targeting up to 26% market share. Our robust platform caters to a market ripe for innovation.

Team and Compliance:

Our team of seasoned professionals and certified Head of Investment collaborates with compliance officers, legal firms, software houses, IT security consultants, investment research firms, and other professionals from the industry, adhering strictly to investment regulations and international IT security standards.

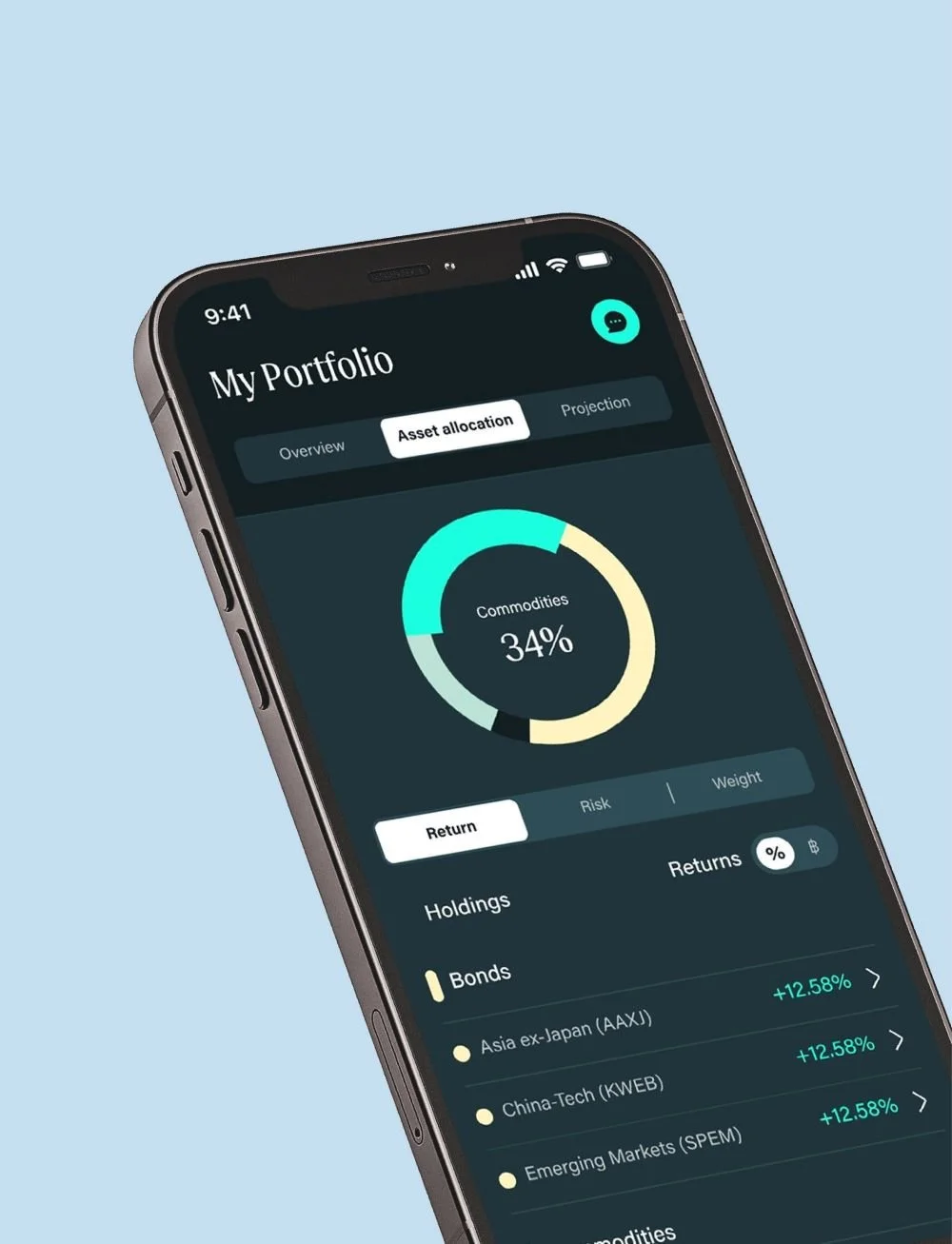

How we declutter investment

Product features

Sustainable growth

Delivering consistently high returns with low volatility

Fuss-free journey

Simplified investment process with an intuitive customer-centric experience into one “Tap & Leave” feature

End to end solution

All key benefits that are generally expected from any investment services are packed into a single product

Multi-asset Allocation

Expected Performance

Return 8%

Standard Deviation 6%

Sharpe ratio 1.0

Maximum drawdown -10%

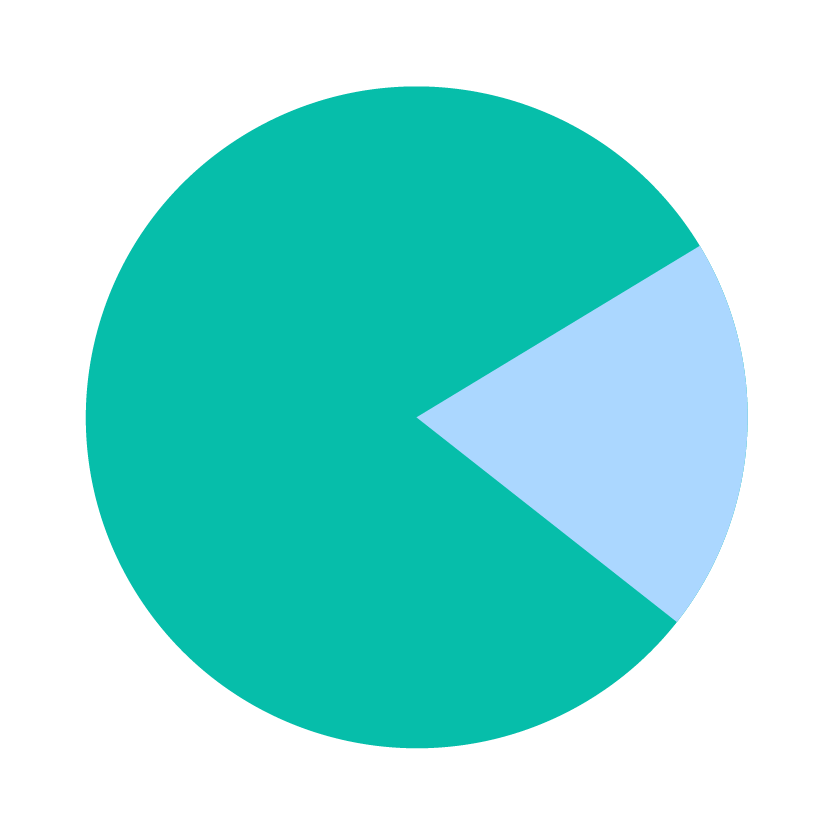

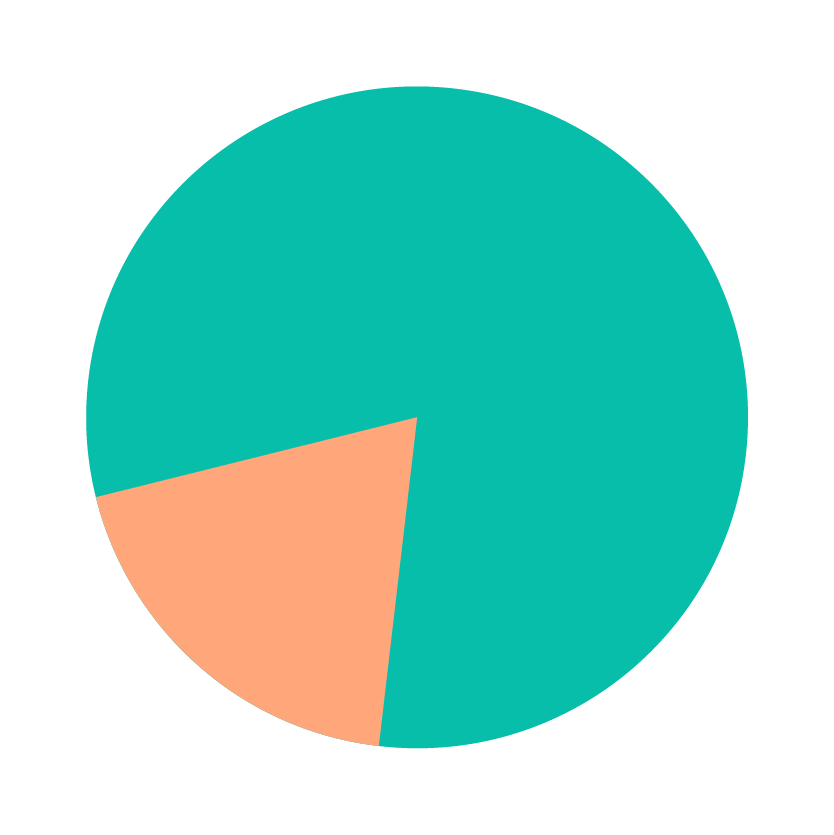

How our fee is calculated

THB 1,250

Fixed fee:

THB 1,250 / month

(for every 1 million baht or 1.5% of AUM)

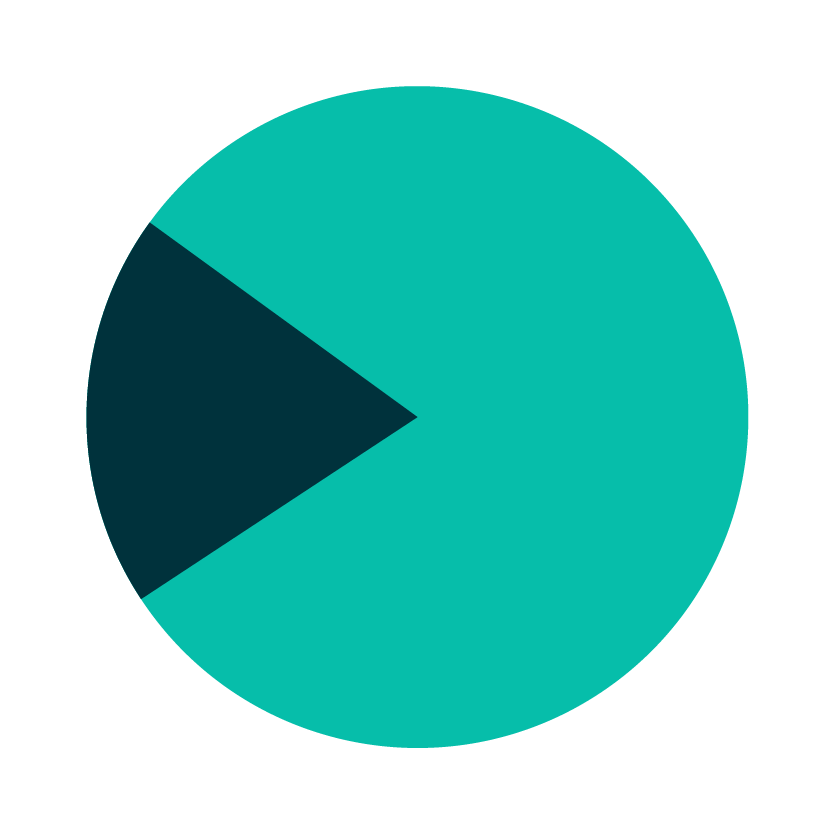

10%

Success-based fee* is applied only when performance outpaces risk, achieving a Sharpe ratio above 1.0.